All Categories

Featured

Table of Contents

Insurer won't pay a minor. Rather, think about leaving the cash to an estate or trust. For more comprehensive information on life insurance policy obtain a duplicate of the NAIC Life Insurance Policy Buyers Guide.

The internal revenue service puts a limit on exactly how much money can enter into life insurance policy costs for the plan and exactly how rapidly such premiums can be paid in order for the plan to preserve all of its tax advantages. If specific limitations are gone beyond, a MEC results. MEC policyholders may go through taxes on distributions on an income-first basis, that is, to the extent there is gain in their plans, in addition to fines on any kind of taxable amount if they are not age 59 1/2 or older.

Please note that outstanding financings build up interest. Revenue tax-free therapy likewise assumes the funding will become satisfied from earnings tax-free survivor benefit proceeds. Finances and withdrawals lower the policy's cash value and survivor benefit, might create certain plan benefits or motorcyclists to end up being inaccessible and might increase the opportunity the plan might gap.

A customer may certify for the life insurance, but not the cyclist. A variable global life insurance policy contract is a contract with the primary objective of giving a death advantage.

Where can I find Wealth Transfer Plans?

These profiles are closely managed in order to satisfy stated financial investment goals. There are charges and fees related to variable life insurance policy contracts, consisting of death and risk costs, a front-end load, management fees, investment monitoring fees, abandonment charges and charges for optional motorcyclists. Equitable Financial and its affiliates do not offer lawful or tax advice.

And that's wonderful, since that's precisely what the fatality benefit is for.

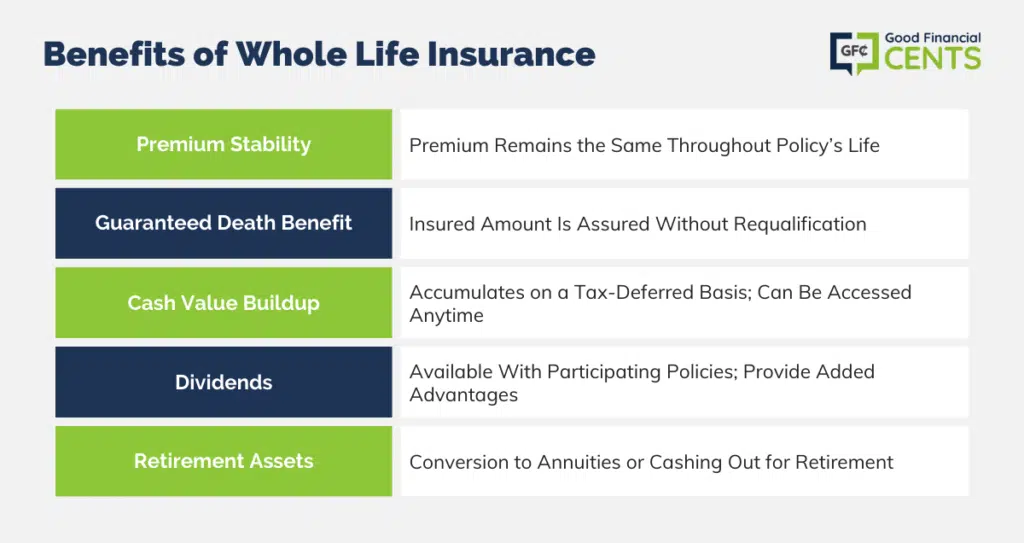

What are the benefits of entire life insurance? One of the most attractive benefits of buying a whole life insurance coverage plan is this: As long as you pay your premiums, your death advantage will certainly never end.

Believe you do not require life insurance policy if you don't have youngsters? You might intend to reconsider. It might appear like an unnecessary expenditure. But there are many advantages to having life insurance coverage, also if you're not sustaining a family. Here are 5 factors why you ought to acquire life insurance policy.

What is a simple explanation of Death Benefits?

Funeral costs, interment expenses and medical costs can include up (Level term life insurance). The last thing you want is for your enjoyed ones to bear this extra worry. Permanent life insurance policy is available in various amounts, so you can choose a survivor benefit that satisfies your needs. Alright, this set only uses if you have youngsters.

Identify whether term or long-term life insurance policy is ideal for you. As your personal circumstances modification (i.e., marital relationship, birth of a youngster or job promo), so will your life insurance policy requires.

Essentially, there are two kinds of life insurance policy intends - either term or long-term strategies or some mix of the 2. Life insurance providers offer different kinds of term plans and typical life policies as well as "rate of interest delicate" items which have actually ended up being much more common since the 1980's.

Term insurance gives security for a specified amount of time. This duration can be as short as one year or give insurance coverage for a certain number of years such as 5, 10, twenty years or to a specified age such as 80 or in some instances as much as the earliest age in the life insurance mortality tables.

Who offers flexible Premium Plans plans?

Currently term insurance rates are very affordable and among the cheapest historically skilled. It ought to be kept in mind that it is a widely held idea that term insurance policy is the least pricey pure life insurance policy protection offered. One needs to evaluate the plan terms thoroughly to determine which term life options appropriate to satisfy your particular conditions.

With each new term the costs is increased. The right to restore the policy without evidence of insurability is an important benefit to you. Otherwise, the risk you take is that your health might wear away and you might be incapable to get a policy at the very same prices or also at all, leaving you and your beneficiaries without protection.

The length of the conversion period will vary depending on the kind of term plan purchased. The premium rate you pay on conversion is usually based on your "current acquired age", which is your age on the conversion day.

Under a level term plan the face amount of the policy stays the same for the entire duration. Usually such policies are sold as home loan security with the quantity of insurance reducing as the balance of the home mortgage reduces.

What is the process for getting Beneficiaries?

Commonly, insurance providers have not had the right to transform premiums after the plan is sold. Because such policies might proceed for several years, insurance companies need to use conservative death, interest and expenditure rate price quotes in the premium calculation. Adjustable costs insurance policy, however, permits insurance companies to offer insurance coverage at reduced "existing" costs based upon much less conservative presumptions with the right to change these premiums in the future.

While term insurance is developed to give protection for a specified period, permanent insurance policy is made to supply coverage for your entire life time. To keep the premium rate degree, the costs at the more youthful ages goes beyond the real price of protection. This extra costs constructs a reserve (cash money worth) which helps pay for the policy in later years as the expense of defense rises above the premium.

The insurance policy firm spends the excess costs bucks This type of plan, which is in some cases called cash worth life insurance policy, produces a cost savings component. Cash values are critical to an irreversible life insurance policy.

Latest Posts

Funeral Insurance For Over 65

Global Burial Insurance

Life Insurance Quotes Online Instant